Over the previous 20 years, U.S. hospitals have absorbed practically $745 billion in uncompensated care, based on the American Hospital Association. This burden continues to develop as hospitals wrestle to confirm energetic insurance coverage. The duty is made tougher by sufferers regularly altering jobs, relocating and shifting by means of a fragmented payer system that suppliers should observe and interpret. The outcome? Missed billing alternatives, delayed funds and pointless write-offs threaten not solely the hospital’s monetary stability, but in addition their capacity to offer care to their communities.

Now, the newly enacted ”One Big Beautiful Bill Act” provides much more stress. With sweeping Medicaid cuts and stricter eligibility guidelines, thousands and thousands of People might lose protection — and hospitals might face a pointy rise in uncompensated care. Key provisions embrace:

- Extra frequent eligibility evaluations (each six months as an alternative of yearly)

- Greater out-of-pocket prices (as much as $35 per physician go to)

- New limits on state Medicaid funding (together with bans on supplier taxes)

In keeping with the Congressional Budget Office, an estimated 11.8 million folks might lose Medicaid protection by 2034. These adjustments shift extra monetary duty to hospitals and sufferers.

However the influence isn’t simply monetary. For sufferers, undetected protection can result in shock payments, postponed therapy, and even collections, all of which erode belief within the healthcare system. Susceptible populations, significantly these affected by the newest Medicaid adjustments, are on the best danger of falling by means of the cracks.

Hospitals are dedicated to serving their communities, together with those that might not have the ability to afford to pay. To do that, they have to get well each greenback they’re entitled to. Meaning figuring out protection wherever it exists, even when it’s hidden, forgotten or misclassified.

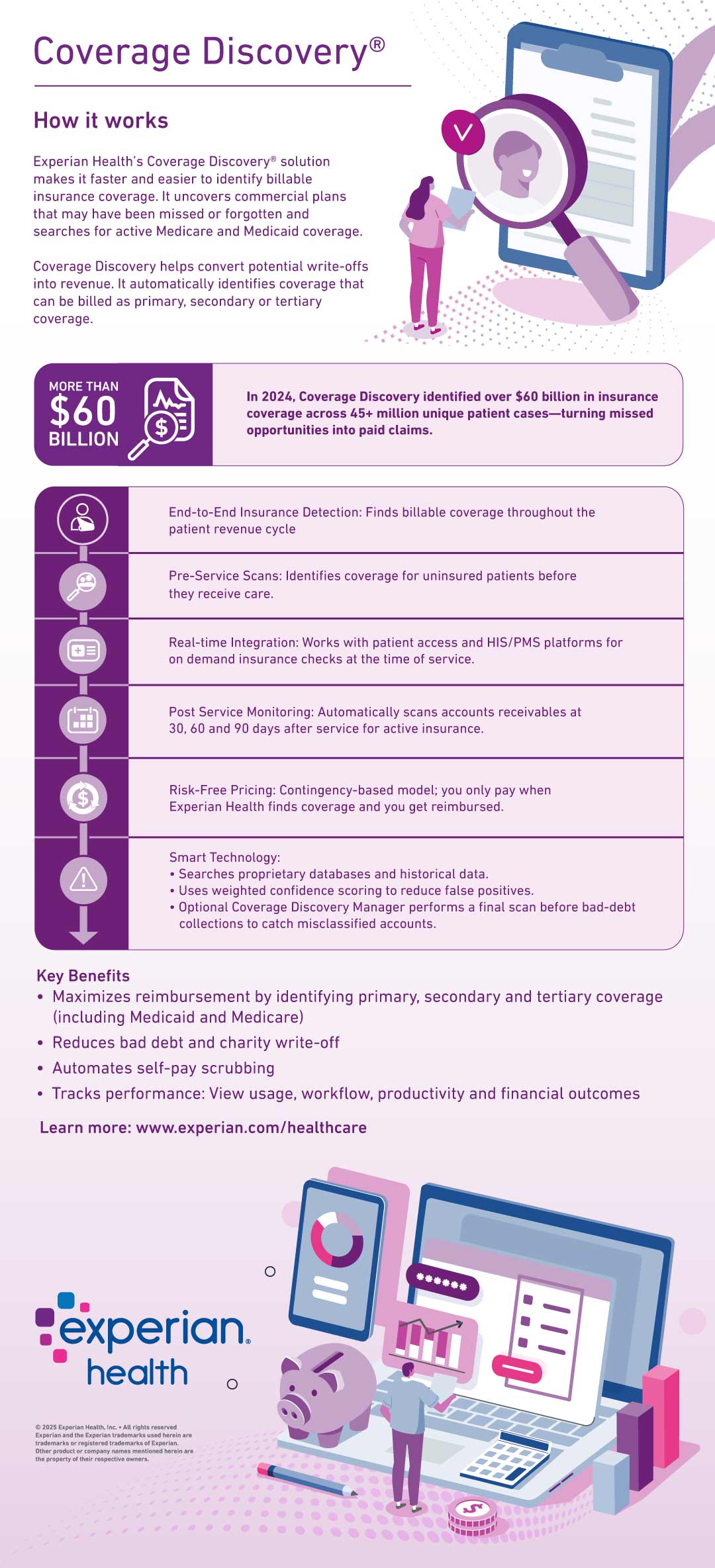

That’s the place Coverage Discovery is available in. Experian Well being’s answer makes use of proprietary knowledge and superior machine studying to determine unknown or forgotten insurance coverage protection throughout your complete income cycle — earlier than, throughout, and after care.

Not like conventional eligibility checks, Coverage Discovery goes deeper. It scans industrial, authorities and third-party payers in actual time; it uncovers main, secondary and even tertiary protection which may in any other case go unnoticed. This proactive strategy helps suppliers invoice the fitting payer the primary time, which reduces denials, accelerates reimbursements, and minimizes dangerous debt.

Protection Discovery recognized over $60 billion in insurance coverage protection throughout 45+ million distinctive affected person circumstances in 2024 alone, turning missed alternatives into paid claims.

In a time of uncertainty, readability is important. Coverage Discovery empowers suppliers to take management of the protection hole — not simply react to it. By surfacing hidden protection early and infrequently, hospitals can defend their monetary well being whereas enhancing the affected person expertise.

Right here’s the way it all comes collectively: